FAB Salary Check & Balance Enquiry | First Abu Dhabi Bank (FAB)

To easily perform a FAB salary check online, new users of FAB can start by downloading the FAB mobile app. This convenient way to check allows users to check your fab account balance anytime, anywhere. Simply log in with your card ID for your FAB Ratibi card. and navigate to the fab balance enquiry section to check your fab bank balance with ease. You can also check the fab balance online by visiting the official website, where you can perform a fab balance check and view your FAB Ratibi card details. salary account balance.

For those using a ratibi prepaid card or fab prepaid card, you can perform a prepaid card balance check via the FAB ATM or through the app. Additionally, salary payments are deposited directly into your bank salary account, making it easy to check the balance and review your transaction history. Remember to maintain the minimum balance to avoid any fees and take advantage of the latest FAB Ratibi card offers for your account in Dubai.

What is the Best Method to Check Your FAB Balance ?

If you’re looking for the best way to check your fab bank salary account balance, you’re in luck! There are a ton of options available that make it super easy to keep track of your finances. First off, you can always do a bank salary account balance check online through the fab bank balance online feature. It’s just a few clicks away! You can also use the fab mobile app to check your fab salary account balance online. Seriously, it’s like having a mini bank in your pocket. Plus, if you’re out and about, you can do a quick balance using the fab mobile app, which is super convenient.

Another way to keep tabs on your finances is by using the FAB Bank ATM. Just pop in your card, and you can view your account balance in seconds. This simple method allows you to check your balance and other details whenever you need. For even greater convenience, you can manage your bank balances online by mastering the FAB mobile app and other digital tools. If you’re just starting your banking journey, it’s helpful to learn how to open a FAB Bank account in the UAE, so you can take full advantage of these features and manage your finances like a pro!

Checkout the following methods to check your FAB Balance Online Instantly:

- FAB bank Balance check via Official FAB Website

- FAB bank Balance check Via the FAB Mobile App

- FAB bank Balance check via FAB Bank ATM

- FAB bank Balance check via the Customer Care Phone Number

- FAB bank Balance check via FAB Net Banking Service

FAB Balance Check Using the Official FAB Website

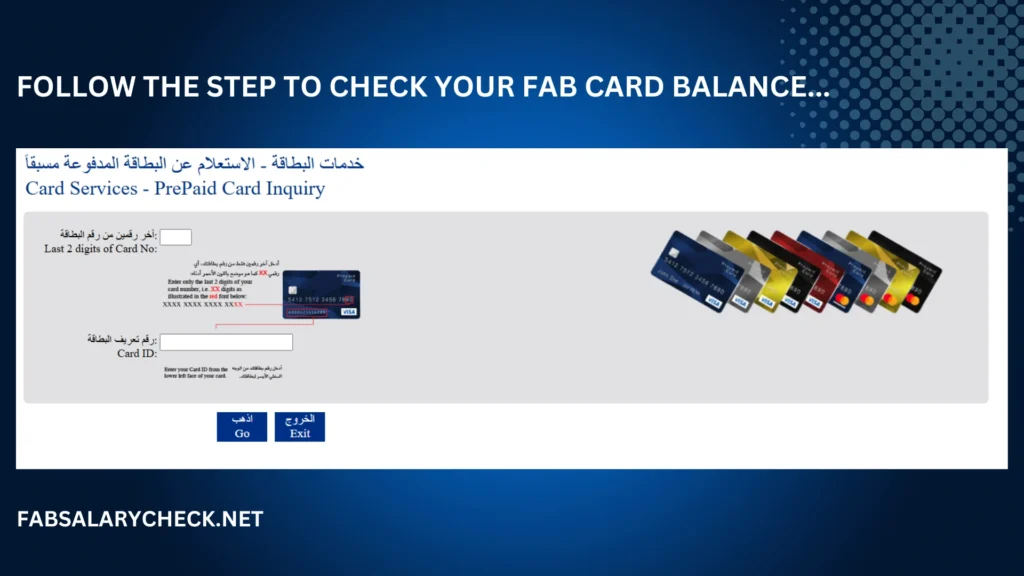

The easiest way to check your FAB Bank balance is through the official website of First Abu Dhabi Bank. Follow this step-by-step guide to check your balance:

Step 1: Visit the official FAB website and navigate to the card services page.

Step 2: Enter the last two digits of your FAB ATM card in the first input box.

Step 3: Provide your card ID number in the designated field.

Step 4: Complete the remaining required information.

Step 5: Click the “Go” button to proceed.

Step 6: Your dashboard will appear, showing your bank balance and other essential details.

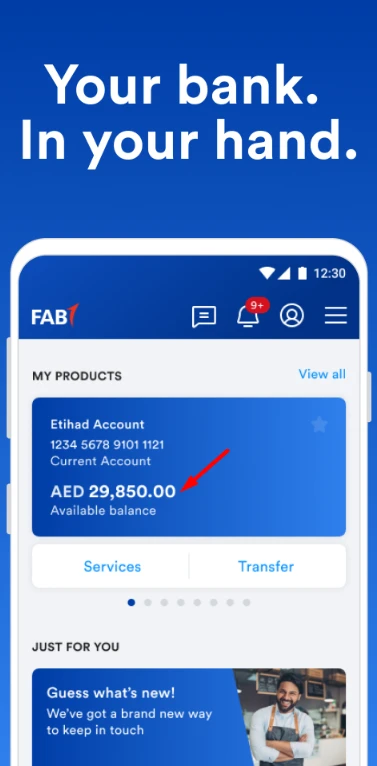

Using the FAB Mobile App for Balance Inquiry

Using the FAB Mobile App for Balance inquiry is a convenient way to manage your finances and stay updated on your account information. With the app, users can easily perform a balance check to see their FAB offers and recent transactions. The app also allows users to view their balance and the history of transactions, making it easier to understand spending patterns.

The FAB Mobile App offers a seamless and secure way to check your balance on the go. Here’s how to use it:

Step 1: Download the App

Find the FAB app on Google Play or the Apple App Store and install it on your device.

Step 2: Log In

Log in using your credentials or register as a new user by entering your debit card details, phone number, email, and setting up a secure password.

Step 3: Navigate

Select the “Account Summary” option to instantly view your balance.

Step 4: Explore Additional Features

Access your transaction history, manage payments, and set alerts for salary deposits directly within the app.

FAB Application download link :

The app also provides features like locating nearby ATMs, instant fund transfers, and personalized notifications to keep you updated on important account activities. Frequent updates to the app ensure enhanced security and added functionality.

For those needing to conduct a fab balance enquiry via the app, the process is straightforward. Users can check their fab bank balance at any time, ensuring they stay informed about their financial status. By utilizing the fab balance check online feature in 2025, customers can quickly verify their balance through the official app or via the First Abu Dhabi Bank website. This enhances the understanding of the bank app and its various payment processes, enabling users to efficiently manage bank balances online and keep track of their fab salary check.

Checking Balance via FAB Bank ATMs

Another effective method to check your balance is through FAB Bank ATMs. These machines are strategically located across the UAE, making it convenient for customers to access their account information. By using your FAB bank card, you can easily check your balance, perform a FAB salary check, and even print a mini statement. The ATMs provide an intuitive interface that guides you through the process step by step.

To utilize this service, customers simply need to visit the nearest bank ATM, where they can log in online using their secure credentials. Once logged in, they check the card and enter their details to access their account information. This includes performing a fab salary check to view recent deposits and confirm that the funds into their account are accurately reflected.

Checking your balance via an ATM is quick and convenient. Follow these steps:

Step 1: Locate the nearest FAB ATM using the bank’s ATM locator on the website or app.

Step 2: Insert your FAB debit card and enter your PIN.

Step 3: Select “Balance Inquiry” from the menu.

Step 4: View or print your account balance for reference.

FAB ATMs are equipped with the latest technology to ensure your transactions are processed smoothly. Whether you need to check your salary or perform a card balance check, these machines offer a reliable solution. Additionally, FAB ATMs are accessible 24/7, providing you with the flexibility to manage your finances at any time of the day or night, which is particularly beneficial for those with hectic schedules.

FAB Balance Check Via Customer Care Phone Number

For direct assistance, FAB’s customer care team is available 24/7. Simply dial 600 52 5500 (UAE) or +971 2 6811511 (International). Follow the prompts for balance inquiries. You will receive an SMS with your account details. If you encounter any issues or require further assistance, you can also reach out to FAB via their official website or mobile app, where you can chat with a representative or access a variety of self-service options.

Additionally, you can visit any FAB branch for face-to-face support. Remember to have your account information handy for a smoother experience. Thank you for choosing FAB, where your banking needs are our priority!

Why Choose This Method?

- Ideal for users who need immediate assistance or face technical difficulties with other methods.

- Multilingual support ensures that customers from diverse backgrounds can get help.

The customer care team is also equipped to handle queries related to loan applications, card issues, and transaction disputes. Additionally, the method provides a streamlined process that minimizes wait times, allowing users to quickly connect with a representative who can address their concerns in real-time.

This approach not only enhances customer satisfaction but also builds trust and reliability in the service. With the ability to escalate issues swiftly, users can feel confident that their problems will be resolved efficiently. Furthermore, the user-friendly interface and accessibility across various devices make it convenient for customers to seek help whenever and wherever they need it.

FAB Balance Check through SMS Banking

FAB customers can also check their balance through SMS banking. FAB customers can also check their balance through SMS banking by sending a predefined code to a designated number. To do this, customers need to register their mobile numbers with the bank and ensure that they have activated SMS banking services.

Once registered, they can simply send a text message containing the code for balance inquiry, and they will receive an instant response with their current account balance. Steps to follow:

Step 1: Register Your Mobile Number

Visit a FAB branch or register your mobile number online with FAB.

Step 2: Send an SMS

Send a balance inquiry SMS to the designated FAB number.

Step 3: Receive a Reply

You will receive a reply with your account balance within seconds.

This is a great option for users without internet access, offering quick and reliable updates. SMS banking can also be used to request mini-statements or check the status of recent transactions. Additionally, customers can utilize SMS banking for various other services, enhancing the overall banking experience. Here are some more features available through FAB SMS banking:

- Fund Transfers: Customers can send money to other FAB accounts or even to accounts at other banks using simple SMS commands.

- Bill Payments: Easily pay utility bills or make credit card payments directly from your account without needing to log into the app or website.

- Transaction Alerts: Stay informed about recent transactions and account activities by receiving real-time alerts via SMS, helping you monitor your account for any unauthorized activity.

- Account Information: Customers can request information such as account statements, interest rates, and product details through SMS.

- Customer Support: For any queries or assistance, customers can send an SMS to receive quick responses from the FAB customer service team.

To use these features, customers should refer to the official FAB SMS banking guide, which provides detailed instructions and a list of commands. Remember that standard SMS charges may apply based on your mobile carrier’s rates when using the FAB balance inquiry service. This service is especially useful for those on the go or in areas with limited internet connectivity, ensuring that banking needs are met efficiently and securely.

FAB Balance Check – A Video Guide

Using the FAB Net-Banking for Balance Check

FAB’s online banking platform is another excellent method for performing a balance check online. Through the official FAB website, you can log into your account, check your balance, and conduct various banking transactions from the comfort of your home. This platform is designed for users who prefer managing their finances through a desktop or laptop, offering a comprehensive view of your financial activities.

For those who prefer online banking, the FAB website offers a comprehensive platform:

Step 1: Log In

Log in to your online banking account at www.bankfab.com for all your FAB balance inquiry needs.

Step 2: Navigate

Go to the “Accounts” section to view your balance and transaction history.

Step 3: Download Statements

Download detailed statements if needed for tracking expenses or auditing purposes.

Step 4: Explore Additional Features

Utilize features like fund transfers, bill payments, and credit card management for seamless banking.

Ensure your internet connection is secure to maintain privacy and protect sensitive financial data. Online banking also enables you to schedule future transactions and set recurring payments.

What is the FAB Bank Swift Code?

The FAB Bank Swift Code, also known as the SWIFT number, is a standardized format for Business Identifier Codes (BIC) used by banks and financial institutions worldwide. This unique code is crucial for identifying banks during international financial transactions and secure communication between financial institutions.

FAB’s official SWIFT code is NBADAEAAXXX. It facilitates both domestic and international money transfers, ensuring transactions are processed securely and reliably. Whether you’re receiving payments from abroad or sending funds to another country, this code is a key component of seamless global banking.

Key Features of the FAB Swift Code:

- Universal Bank Identifier: Used for international money transfers and communications.

- Security: Ensures secure and encrypted transactions globally.

- Efficiency: Avoids errors and delays in cross-border payments.

How to Use the FAB Bank Swift Code:

- For Receiving Payments: Share the Swift Code NBADAEAAXXX, along with your IBAN and account number, with the sender.

- For Sending Payments: Provide the recipient’s Swift Code, IBAN, and account details when initiating an international transfer.

FAB Ratibi Card Balance Inquiry

The FAB Ratibi Prepaid Card is a convenient tool for salary disbursals and daily transactions. Checking the balance on your Ratibi card is simple and accessible for all users, including new customers who may feel unsure about online processes.

Steps to Check FAB Ratibi Card Balance:

- Visit the official FAB website.

- Navigate to the Ratibi Prepaid Card Balance Check section.

- Enter your card number and ID details.

- Click “Go” to instantly view your remaining balance.

This easy-to-use service allows Ratibi cardholders to stay updated on their available funds without visiting a branch or ATM.

Advantages of the FAB Balance Check Service

If you’re banking with FAB Bank, you’ve got some cool perks at your fingertips, especially if you’re looking to manage your FAB salary and bank account easily. With the FAB Balance Check Service, you can check your FAB balance online in just a few taps. Whether you’re curious about your account balance or need a quick salary check, this service makes it super simple. Just fire up the FAB mobile app or hop onto the FAB website, and boom! You can easily check your FAB salary account balance

The FAB balance check service provides numerous advantages, including:

- Convenience: Check your balance anytime, anywhere.

- Real-Time Updates: Stay informed about your latest transactions and deposits.

- Secure Access: All methods ensure encrypted and safe data handling.

- Multiple Options: Choose from mobile apps, ATMs, online banking, or customer care.

- No Additional Fees: Balance inquiries are free of charge on digital platforms.

- Accessibility: Options like SMS banking ensure you can check your balance even without a smartphone or internet access.

Additionally, these services help customers maintain financial discipline by enabling easy tracking of expenses and setting savings goals.

FAB Balance Check in Abu Dhabi 2025

Residents in Abu Dhabi benefit from FAB’s extensive network of branches, ATMs, and digital services. Highlights include: Residents in Abu Dhabi benefit from FAB’s extensive network of branches, ATMs, and digital services. Highlights include:

- Comprehensive customer care support available 24/7.

- Real-time balance updates through digital channels.

- Services catering to both residents and tourists.

In summary, FAB’s commitment to providing comprehensive banking solutions and exceptional customer service ensures that residents of Abu Dhabi have the tools and support they need to achieve their financial goals.

Tips to Manage Your FAB Bank Balance

If you wanna keep your FAB balance in check and avoid the stress of running low on funds, here are some chill tips! First off, don’t forget to do a quick balance check using the FAB mobile app or the FAB website. You can even check your balance online anytime, like after you get that sweet salary deposit! Plus, a simple salary check can save you from some nasty surprises. Trust me, staying on top of your bank account is key, especially if you’re in the UAE and want to manage your FAB salary account balance effectively. Some of other step:

- Set Alerts: Use the mobile app to set notifications for salary deposits or low balances.

- Monitor Spending: Regularly check transaction history to identify unnecessary expenses.

- Plan Budgets: Use FAB’s financial planning tools available on the app and website.

- Stay Updated: Subscribe to FAB’s newsletters or notifications to learn about new features or updates.

- Use Auto-Debit: Set up automatic bill payments to avoid late fees and manage cash flow effectively.

Another cool trick is to set alerts for when your salary drops or when your balance hits a certain low. And hey, take a moment to monitor your spending too! Regularly check your transaction history to spot any unnecessary expenses. Planning budgets is super easy with FAB’s tools available on the app and website, so make use of them. Also, be sure to stay updated with FAB bank offers through their newsletters, and don’t forget to set up auto-debit for bills to dodge those pesky late fees!

Additional Online Services Offered by FAB Bank

FAB offers an array of online services to make banking convenient, including:

- Bill Payments: Pay utility bills directly through the app or website.

- Fund Transfers: Send money locally or internationally with ease.

- Credit Card Management: Track expenses, pay bills, and redeem rewards.

- Loan Management: Apply for and manage loans with complete transparency.

- Investment Tracking: Monitor your portfolio and access investment advice through FAB’s digital tools.

These services enhance the overall banking experience, making FAB a preferred choice in the UAE.

FAQs

You can check your FAB salary card balance using the FAB mobile app, ATM, or by logging into your online banking account. For quick access, use the balance inquiry feature in the app or visit an ATM.

No, FAB’s online banking services are free of charge for balance inquiries and most basic functions. Charges may apply for advanced features like international transfers.

FAB offers the option to save login credentials securely on the mobile app for quicker access while maintaining your account’s security.

Yes, you can check your ATM-linked account balance online using FAB’s mobile app or online banking platform.

Yes, you can access your FAB balance from anywhere globally through the FAB mobile app or online banking. Ensure you have an active internet connection.

Absolutely! The FAB mobile app allows you to check your balance instantly. Simply log in, navigate to the account summary, and view your balance.

Yes, you can link multiple FAB accounts to the mobile app and manage them conveniently under a single login.

Log in to the FAB mobile app or online banking, navigate to “Transaction History,” and select the desired account to view recent transactions.

FAB’s Swift Code is NBADAEAAXXX. It is used for international money transfers to identify the bank globally.

FAB prepaid cards offer convenience, secure salary disbursals, and easy balance inquiries through ATMs, mobile apps, and online banking.

Log in to your FAB online banking account or mobile app and navigate to the account details section to find your IBAN.

The minimum balance for a savings account is AED 3,000. Falling below this incurs a monthly penalty of AED 10.

Contact FAB customer care immediately at 600 52 5500 to report the transaction and freeze your account if necessary.

Use the “Forgot Password” feature on the FAB website or mobile app to reset your password securely.

A FAB bank account offers seamless salary management, international transaction capabilities, and access to exclusive banking benefits tailored for UAE residents.

FAB account balances are updated in real-time, ensuring you always have the latest information.

Conclusion For FAB Salary And Balance Check

FAB’s balance check services are designed to make your financial management effortless and secure. From real-time updates to versatile access options, FAB ensures that you’re always in control of your finances.

Explore the various methods discussed, from mobile apps to SMS banking, and choose the one that fits your lifestyle. Whether you’re at home, in the office, or on the go, FAB’s balance check services provide you with the flexibility to monitor your accounts whenever and wherever you need. With user-friendly mobile applications, you can easily view your account balance, recent transactions, and financial summaries at your fingertips. The intuitive interface makes navigation seamless, allowing you to manage your finances with just a few taps.

With FAB’s commitment to innovation and customer satisfaction, managing your finances has never been easier. Explore these services today and take the first step towards a more organized and secure financial future.